The drugs of tomorrow (Day 188)

1st December 2014

But these medicines are mature and relatively old in drug-years. So what about the next generation and where are the innovations likely to come from?

According to professor Nigel Titchener-Hooker, the next decade will see biologically derived therapies - or 'biologics' - dominate the treatment landscape.

In 2013, eight of the top ten selling drugs worldwide were biologics products manufactured in a living system such as a microorganism, plant or animal cell.

Most biologics - including the top sellers, Humira, Enbrel and Remicade - are very large, complex molecules produced using recombinant DNA technology.

If another indicator of success is how much a market is worth, then pharmaceuticals also achieve top marks with a value of £536bn (US$839bn) in 2013.

Here's the world’s ten best selling prescription drugs for last year:

- At number one in the list we have Adalimumab. Better known by its trade name Humira, this top selling treatment for rheumatoid arthritis and autoimmune diseases generated sales totalling £6.4bn (US$10.7bn) for its owner, Chicago-based Abbvie.

- The number two product is a therapy for rheumatoid arthritis, Enbrel, co-marketed by Amgen and Pfizer. Enbrel grossed £5.6bn (US$8.8bn) last year.

- Completing the top three is another anti-rheumatic treatment, Remicade, which saw sales of £5.4bn (US$8.4bn) for Johnson and Johnson, Merck and others worldwide.

- Advair, also known as Seretide, is a bestselling anti-asthmatic treatment manufactured by UK headquartered GlaxoSmithKline. The product was worth £5.3bn (US$8.3bn) in sales.

- Sanofi’s Lantus is administered daily to millions of diabetic patients. This insulin-based product made sales worth £4.9bn (US$7.6bn) for its Paris-based owners.

- Swiss pharma giant Hoffman-La Roche appears sixth with rheumatoid arthritis treatment Rituxan worth £4.9bn (US$7.6bn).

- Valued at £4.8bn (US$7.5bn) is bowel cancer therapeutic Avastin by Hoffman-La Roche.

- Breast cancer drug Herceptin, also by Hoffman-La Roche, had gross sales of £4.4bn (US$6.8bn).

- Cholesterol-usting medicine, Crestor, produced by AstraZeneca, was valued at£3.6bn (US$5.6bn).

- Otsuka Holdings’ Abilify, a treatment for depressive disorders, grossed £3.5bn (US$5.5bn).

You can find out more about the commercial and clinical performance for this top ten, and hundreds of other medicines, from London-based market analysts, EvaluatePharma.

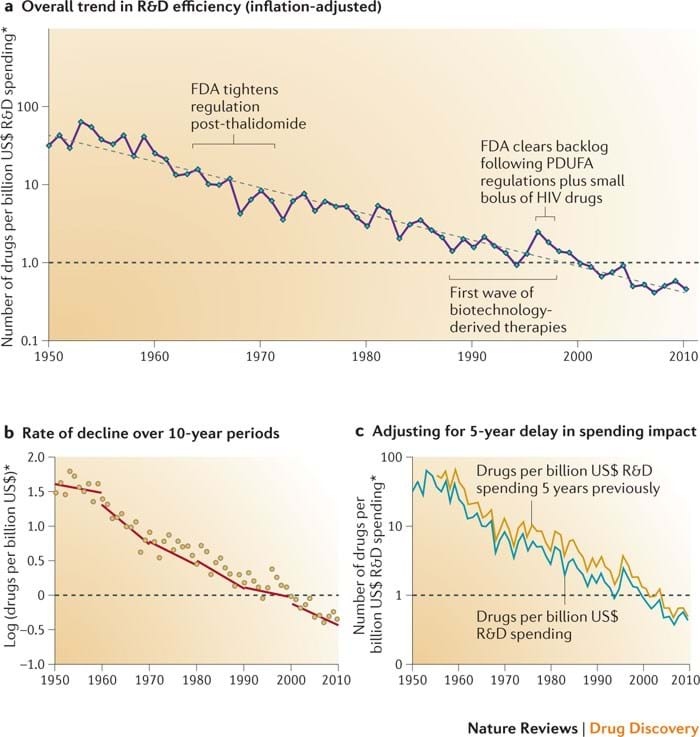

Medicines are clearly a lucrative business, but the pharma industry faces considerable challenges as licences expire for profitable and established products and R&D productivity continues to decline in a manner akin to the computer industry’s by Moore’s law – except in reverse; hence the name Eroom’s Law.

More can actually mean less in when it comes to drug development.

The nature of the products is changing too. Fifteen years ago, the league table was dominated by drugs produced by traditional chemical synthesis.

Today, only three drugs in the top ten - Abilify, Advair and Crestor - are manufactured using the traditional route. All the others are biologics.

He has highlighted that current limitations in downstream processing techniques threaten to obstruct progress and that earlier consideration to bioprocess challenges should be given during drug development.

He believes that companies still tend to progress on the basis of clinical promise. Consideration for the ease of manufacture comes much later, and vital process decisions are isolated from business decisions, with costly consequences.

The new generation of biologics tend to target smaller groups of patients but can be much more expensive.

Gilead Sciences’ new hepatitis-C treatment, Sovaldi, is currently priced at £639 (US$1,000) for just one pill.

A course of treatment costs $84,000 (£54,00) in the US. With prices like this, the need for efficient, cost effective, fully optimised manufacture should come as no surprise.

Nigel firmly believes that biochemical engineering offers the tools and methods to enable more rapid transition from clinical promise to manufacturing certainty.

This enables better business decision-making by leveraging a fundamental understanding of ways to improve purification processes quickly, and with confidence.

Biochemical engineering really matters when it comes to delivering affordable, next generation therapies. In ten year’s time we may be looking at a league table of prescription drugs that is totally dominated by biologics. Biochemical engineers like Nigel Titchener-Hooker will be instrumental in bringing this about.